There are many pros, and some cons, to becoming a financial professional. Here are some of them: Working with clients on an emotional level, complicated compliance guidelines, and the chance to work exclusively in a niche. Read on if you are interested in finding out more. Weigh the pros and cons to decide if this is the career for you. You might be a good fit for a career as a financial adviser. You can find out if this career is right for you by reading the following article.

Working with clients on an emotionally-based level

There are many pros to financial advisor careers, including high stress levels and secondhand stress. The requirement to pass the Series 7 exam. Only about 65% of test-takers pass it the first time. Advisors must also be flexible and able to compete with their peers. If you are willing to face all those challenges, then this could be the right career path for you.

Although empathy is often regarded as a noble human characteristic, there are some disadvantages. An example of this is how empathy can impact a financial advisor’s objectivity, judgement, and emotional well being. To make this job appealing to clients, an advisor must be emotionally intelligent. Financial advisors need to understand the financial circumstances of their clients.

Complicated compliance guidelines

The new compliance rules were created in response to regulatory changes. These regulations regulate the use by firm personnel of investment performance while working for other businesses. These are not the only changes. Max Schatzow, a compliance attorney, said that advisors and firms should find it easier to use the new rules. Advisors need to decide which marketing strategies will work best within the new guidelines. A new rule could help advisors reach younger clients.

While the financial advisor job description may sound ideal, the pressure to generate clients and meet regulatory requirements can be draining. There are many ways to market yourself, but persistence is essential. Sponsorship is essential. Additionally, financial advisors will have to pay $300 per month in insurance costs. But the pros outweigh the cons, particularly if you plan on working with high-net-worth clients.

Only work in a niche

While there are some pros and cons to working in a particular niche, many people feel that focusing on one area is the best choice. A niche allows you to build client relationships and bring in more referrals. However, it's important that you get to know your target market. An advisor who specializes in corporate finance may launch a podcast, which features top corporate lawyers. This podcast will then be promoted via social media. They can also curate content and send a monthly email newsletter to those who have an interest in that niche. Focusing your marketing efforts exclusively on a niche clientele is a great way to save money and also make your career more profitable.

It is possible to work exclusively in one niche. While you might not love your niche, you can always switch to another one if you find the clients you're looking for. You can also change the niche you choose as often as necessary. But, it is important to enjoy the field you are working in. The potential for great income can be found in niche work. It doesn't matter if you enjoy what you do or your clients' needs. You can find a niche to suit you.

FAQ

What are my options for retirement planning?

No. This is not a cost-free service. We offer free consultations to show you the possibilities and you can then decide if you want to continue our services.

How to Choose an Investment Advisor

The process of selecting an investment advisor is the same as choosing a financial planner. Consider experience and fees.

An advisor's level of experience refers to how long they have been in this industry.

Fees are the price of the service. These fees should be compared with the potential returns.

It's crucial to find a qualified advisor who is able to understand your situation and recommend a package that will work for you.

How do I get started with Wealth Management?

The first step towards getting started with Wealth Management is deciding what type of service you want. There are many Wealth Management services, but most people fall within one of these three categories.

-

Investment Advisory Services – These experts will help you decide how much money to invest and where to put it. They advise on asset allocation, portfolio construction, and other investment strategies.

-

Financial Planning Services - A professional will work with your to create a complete financial plan that addresses your needs, goals, and objectives. Based on their professional experience and expertise, they might recommend certain investments.

-

Estate Planning Services – An experienced lawyer can guide you in the best way possible to protect yourself and your loved one from potential problems that might arise after your death.

-

Ensure that the professional you are hiring is registered with FINRA. If you are not comfortable working with them, find someone else who is.

How to Beat Inflation With Savings

Inflation is the rise in prices of goods and services due to increases in demand and decreases in supply. Since the Industrial Revolution, when people started saving money, inflation was a problem. The government attempts to control inflation by increasing interest rates (inflation) and printing new currency. However, you can beat inflation without needing to save your money.

For instance, foreign markets are a good option as they don't suffer from inflation. An alternative option is to make investments in precious metals. Two examples of "real investments" are gold and silver, whose prices rise regardless of the dollar's decline. Investors who are concerned by inflation should also consider precious metals.

What does a financial planner do?

A financial planner is someone who can help you create a financial plan. They can help you assess your financial situation, identify your weaknesses, and suggest ways that you can improve it.

Financial planners are professionals who can help you create a solid financial plan. They can tell you how much money you should save each month, what investments are best for you, and whether borrowing against your home equity is a good idea.

Financial planners usually get paid based on how much advice they provide. However, some planners offer free services to clients who meet certain criteria.

Why is it important to manage wealth?

The first step toward financial freedom is to take control of your money. Understanding your money's worth, its cost, and where it goes is the first step to financial freedom.

You must also assess your financial situation to see if you are saving enough money for retirement, paying down debts, and creating an emergency fund.

You could end up spending all of your savings on unexpected expenses like car repairs and medical bills.

Statistics

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

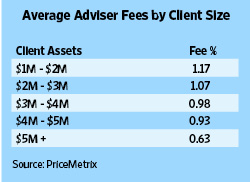

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

External Links

How To

How to invest after you retire

People retire with enough money to live comfortably and not work when they are done. But how can they invest that money? You can put it in savings accounts but there are other options. For example, you could sell your house and use the profit to buy shares in companies that you think will increase in value. Or you could take out life insurance and leave it to your children or grandchildren.

However, if you want to ensure your retirement funds lasts longer you should invest in property. As property prices rise over time, it is possible to get a good return if you buy a house now. If you're worried about inflation, then you could also look into buying gold coins. They don't lose value like other assets, so they're less likely to fall in value during periods of economic uncertainty.