Consider hiring a financial adviser to assist you with major life transitions. A financial advisor will help you plan the future for both yourself and your child. A financial advisor can also assist you in the financial planning process for your spouse. This article will explain how to choose a fee-based financial advisor. After reading this article, you'll be ready to hire a financial advisor.

Finding a qualified financial advisor

It is important to research the education and credentials of your financial advisor before you decide to hire him or her to assist you with your investments. The majority of this information is found in Form ADV which can be found at the SEC’s investment advisor public disclosure webpage. If you do not see the information you require, your advisor will be able to provide it. Also, be sure to check the advisor's fiduciary status. Fiduciary status indicates that advisors put your best interest first.

Selecting a fee-based advisor in financial planning

It can be a good idea to choose a fee-based adviser for a number of reasons. This advisor is paid a flat fee. They are only paid if you reach your financial goals. You should verify the credentials and registrations of advisors. You should also inquire about the methods of compensation and set up appointments with multiple advisors. You don't have to accept the first advisor that you meet.

Understanding the fiduciary obligation of a financial advisor

The name of the fiduciary duty of an investment advisor is to act in the best client's interests. In the United States, this means putting their client's interests first, even if it means not making money. Investment advisors should be registered with both the Securities and Exchange Commission and each state in which they operate. However, not all financial advisers are fiduciaries. Brokers aren't required to be fiduciaries. However they have a duty not to recommend inappropriate products.

For marriage, a financial advisor

A financial advisor is beneficial to couples. A financial advisor can help couples navigate their finances and set goals that are beneficial for them both. A financial planner can also ensure that couples stick to an appropriate strategy. The advisor will also help them determine if they should have separate accounts or joint accounts. A financial planner may be a good idea to help couples avoid making common financial mistakes. This is the most important guide for couples. It's worth getting one as soon possible.

A robo-advisor

Robotic advisors are able to pick investments for you but they cannot manage the emotional side. A financial advisor, a human being, can help guide you through emotions and help you make decisions based upon your particular circumstances. Working with a human advisor, however is the best way to participate in the process. A financial advisor will help customize your investment portfolio according to your needs and can adjust the asset allocations to suit your needs.

FAQ

How to Beat Inflation by Savings

Inflation refers the rise in prices due to increased demand and decreased supply. It has been a problem since the Industrial Revolution when people started saving money. The government regulates inflation by increasing interest rates, printing new currency (inflation). You don't need to save money to beat inflation.

For example, you can invest in foreign markets where inflation isn't nearly as big a factor. Another option is to invest in precious metals. Because their prices rise despite the dollar falling, gold and silver are examples of real investments. Precious metals are also good for investors who are concerned about inflation.

What is retirement planning?

Retirement planning is an essential part of financial planning. This helps you plan for the future and create a plan that will allow you to retire comfortably.

Retirement planning means looking at all the options that are available to you. These include saving money for retirement, investing stocks and bonds and using life insurance.

Do I need to make a payment for Retirement Planning?

No. All of these services are free. We offer free consultations to show you the possibilities and you can then decide if you want to continue our services.

Who Should Use A Wealth Manager?

Everyone who wishes to increase their wealth must understand the risks.

Investors who are not familiar with risk may not be able to understand it. Bad investment decisions could lead to them losing money.

The same goes for people who are already wealthy. They might feel like they've got enough money to last them a lifetime. But they might not realize that this isn’t always true. They could lose everything if their actions aren’t taken seriously.

As such, everyone needs to consider their own personal circumstances when deciding whether to use a wealth manager or not.

Where can you start your search to find a wealth management company?

If you are looking for a wealth management company, make sure it meets these criteria:

-

A proven track record

-

Is based locally

-

Offers free initial consultations

-

Provides ongoing support

-

There is a clear pricing structure

-

Excellent reputation

-

It is simple to contact

-

We offer 24/7 customer service

-

Offers a variety products

-

Low fees

-

There are no hidden fees

-

Doesn't require large upfront deposits

-

You should have a clear plan to manage your finances

-

You have a transparent approach when managing your money

-

Makes it easy to ask questions

-

Have a good understanding of your current situation

-

Understand your goals & objectives

-

Would you be open to working with me regularly?

-

You can get the work done within your budget

-

Good knowledge of the local markets

-

We are willing to offer our advice and suggestions on how to improve your portfolio.

-

Is available to assist you in setting realistic expectations

How do you get started with Wealth Management

The first step towards getting started with Wealth Management is deciding what type of service you want. There are many Wealth Management options, but most people fall in one of three categories.

-

Investment Advisory Services: These professionals can help you decide how much and where you should invest it. They advise on asset allocation, portfolio construction, and other investment strategies.

-

Financial Planning Services: This professional will work closely with you to develop a comprehensive financial plan. It will take into consideration your goals, objectives and personal circumstances. They may recommend certain investments based upon their experience and expertise.

-

Estate Planning Services - An experienced lawyer can advise you about the best way to protect yourself and your loved ones from potential problems that could arise when you die.

-

Ensure they are registered with FINRA (Financial Industry Regulatory Authority) before you hire a professional. You can find another person who is more comfortable working with them if they aren't.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

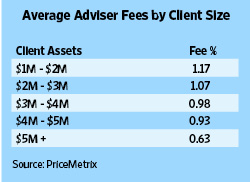

- These rates generally reside somewhere around 1% of AUM annually, though rates usually drop as you invest more with the firm. (yahoo.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

External Links

How To

How to save cash on your salary

It takes hard work to save money on your salary. These are the steps you should follow if you want to reduce your salary.

-

It's better to get started sooner than later.

-

You should cut back on unnecessary costs.

-

Online shopping sites like Flipkart or Amazon are recommended.

-

Do your homework at night.

-

It is important to take care of your body.

-

It is important to try to increase your income.

-

Live a frugal existence.

-

Learn new things.

-

Sharing your knowledge is a good idea.

-

It is important to read books on a regular basis.

-

Make friends with people who are wealthy.

-

It's important to save money every month.

-

For rainy days, you should have money saved.

-

Plan your future.

-

You should not waste time.

-

You must think positively.

-

Negative thoughts are best avoided.

-

God and religion should always be your first priority

-

Good relationships are essential for maintaining good relations with people.

-

You should enjoy your hobbies.

-

Try to be independent.

-

Spend less than you earn.

-

Keep busy.

-

Patient is the best thing.

-

Always remember that eventually everything will end. It is better to be prepared.

-

You should never borrow money from banks.

-

Always try to solve problems before they happen.

-

Get more education.

-

Financial management is essential.

-

Everyone should be honest.