The key to financial stability is building a large amount of home equity. You can do this by making a large downpayment, paying more principal each month, or any combination. You don't need to worry about the value of your home falling. You will always have cash on hand in case something unexpected happens.

Invest in yourself

It is important to invest in your own financial future if you're having trouble meeting your financial goals. You can invest in yourself, your career, your health and well-being, your hobbies, passions and even your relationships. It is possible to invest in yourself and your health by getting regular exercise.

Saving money

You must learn how to control your spending in order to create financial stability. Although this can seem daunting at first, it is possible with patience and education. Understanding your debts and budgeting are two good places to start. It is also helpful to track your salary and expenses. You can also make a list each month of what you are able to afford by tracking how much you spend.

An emergency fund is a must

An emergency fund is an excellent way to prevent financial crises. It's important to establish it as early as possible. It's like a life raft, ready to be used when you need it most. It is also an excellent way to reduce stress and get better sleep at night.

Living on less than you make

Financial stability means living below one's means, spending less than you make, and saving for the future. It also means not having to stress over money or worry about accumulating debt.

It is important to have a plan for dealing with financial challenges

Financial stability means not only having a plan for your finances, but also a plan to deal with the challenges that you may face. Many Americans face financial stress. Research has shown that almost two-thirds of Americans feel financially stressed at times. 22 percent feel very stressed about their financial situation. This is especially true of parents making less than $50,000 a yearly and younger adults. High levels financial stress often lead people to engage in unhealthy behaviors.

A large amount of equity in your house

A large equity stake in your home can be a key factor in financial stability. It can be used to improve your home or consolidate your debt. You can also use the equity as a line of credit. The higher your equity, the more you can borrow from a bank.

FAQ

Who should use a wealth manager?

Everyone who wishes to increase their wealth must understand the risks.

Investors who are not familiar with risk may not be able to understand it. Poor investment decisions could result in them losing their money.

Even those who have already been wealthy, the same applies. Some people may feel they have enough money for a long life. But this isn't always true, and they could lose everything if they aren't careful.

Everyone must take into account their individual circumstances before making a decision about whether to hire a wealth manager.

How to Beat Inflation by Savings

Inflation refers to the increase in prices for goods and services caused by increases in demand and decreases of supply. Since the Industrial Revolution, people have been experiencing inflation. The government regulates inflation by increasing interest rates, printing new currency (inflation). You don't need to save money to beat inflation.

For example, you could invest in foreign countries where inflation isn’t as high. Another option is to invest in precious metals. Silver and gold are both examples of "real" investments, as their prices go up despite the dollar dropping. Precious metals are also good for investors who are concerned about inflation.

What is estate planning?

Estate Planning refers to the preparation for death through creating an estate plan. This plan includes documents such wills trusts powers of attorney, powers of attorney and health care directives. These documents will ensure that your assets are managed after your death.

What is a Financial Planning Consultant? And How Can They Help with Wealth Management?

A financial advisor can help you to create a financial strategy. They can analyze your financial situation, find areas of weakness, then suggest ways to improve.

Financial planners are highly qualified professionals who can help create a sound plan for your finances. They can help you determine how much to save each month and which investments will yield the best returns.

Financial planners are usually paid a fee based on the amount of advice they provide. However, some planners offer free services to clients who meet certain criteria.

Statistics

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

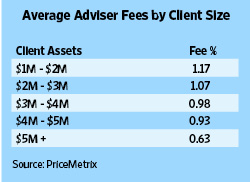

- If you are working with a private firm owned by an advisor, any advisory fees (generally around 1%) would go to the advisor. (nerdwallet.com)

External Links

How To

How to beat inflation with investments

Inflation is one important factor that affects your financial security. It has been observed that inflation is increasing steadily over the past few years. The rate at which inflation increases varies from country to country. India, for example is seeing an inflation rate much higher than China. This means that even though you may have saved money, your future income might not be sufficient. If you don't make regular investments, you could miss out on earning more income. How can you manage inflation?

Stocks investing is one way of beating inflation. Stocks offer you a good return on investment (ROI). These funds can also help you buy gold, real estate and other assets that promise a higher return on investment. However, before investing in stocks there are certain things that you need to be aware of.

First, decide which stock market you would like to be a part of. Do you prefer large-cap companies or small-cap ones? Choose according. Next, consider the nature of your stock market. Is it growth stocks, or value stocks that you are interested in? Next, decide which type of stock market you are interested in. Finally, understand the risks associated with the type of stock market you choose. There are many stock options on today's stock markets. Some are risky while others can be trusted. Be wise.

You should seek the advice of experts before you invest in stocks. They can help you determine if you are making the right investment decision. If you are planning to invest in stock markets, diversify your portfolio. Diversifying your investments increases your chance of making a decent income. You run the risk losing everything if you only invest in one company.

If you still need help, then you can always consult a financial advisor. These professionals can guide you through the process for investing in stocks. They will ensure you make the right choice of stock to invest in. They can help you determine when it is time to exit stock markets, depending upon your goals and objectives.