The question of how many financial advisors are working in the United States poses the question: How many do they have? The number and type of financial planners in America will continue to grow over the coming years. Most are 55 or older. Financial planning does not allow you to retire when you reach Medicare eligibility. The United States needs more financial planners for a variety reasons, including the aging baby boomers and those seeking a higher income.

218,100

Rankings of the top financial professionals are based upon several factors. These factors include years of experience, the size of the firm and regulatory record. Credentials are also important. The list this year includes more than 218 million advisors. This is a testament of the growing importance of financial advisors in our economy and a clear indicator of their value in this field. The Top 50 Financial Advisors of the US are listed below.

Average salary

The average US salary of financial advisors is not the same. It varies widely from one state to another. Financial advisors who work in high-paying areas earn an average of $169,310 per year. Those in lower-paying regions make about half that amount. The highest paying states include Massachusetts, Maine and Minnesota. Utah, Arizona and Tennessee have some of the lowest salaries. The average salary of financial advisors in some states is $52,530.

States with the highest ratio of advisors to their population

According to a SmartAsset report, the number of financial advisors in the US is more concentrated in some states than in others. New York is home to nearly nine financial advisers per 10,000 residents. It's also the most populous. Connecticut is home to many hedge funds and has an average household net worth of $18 million. Connecticut is home to more financial advisors per capita that New York.

Regulations

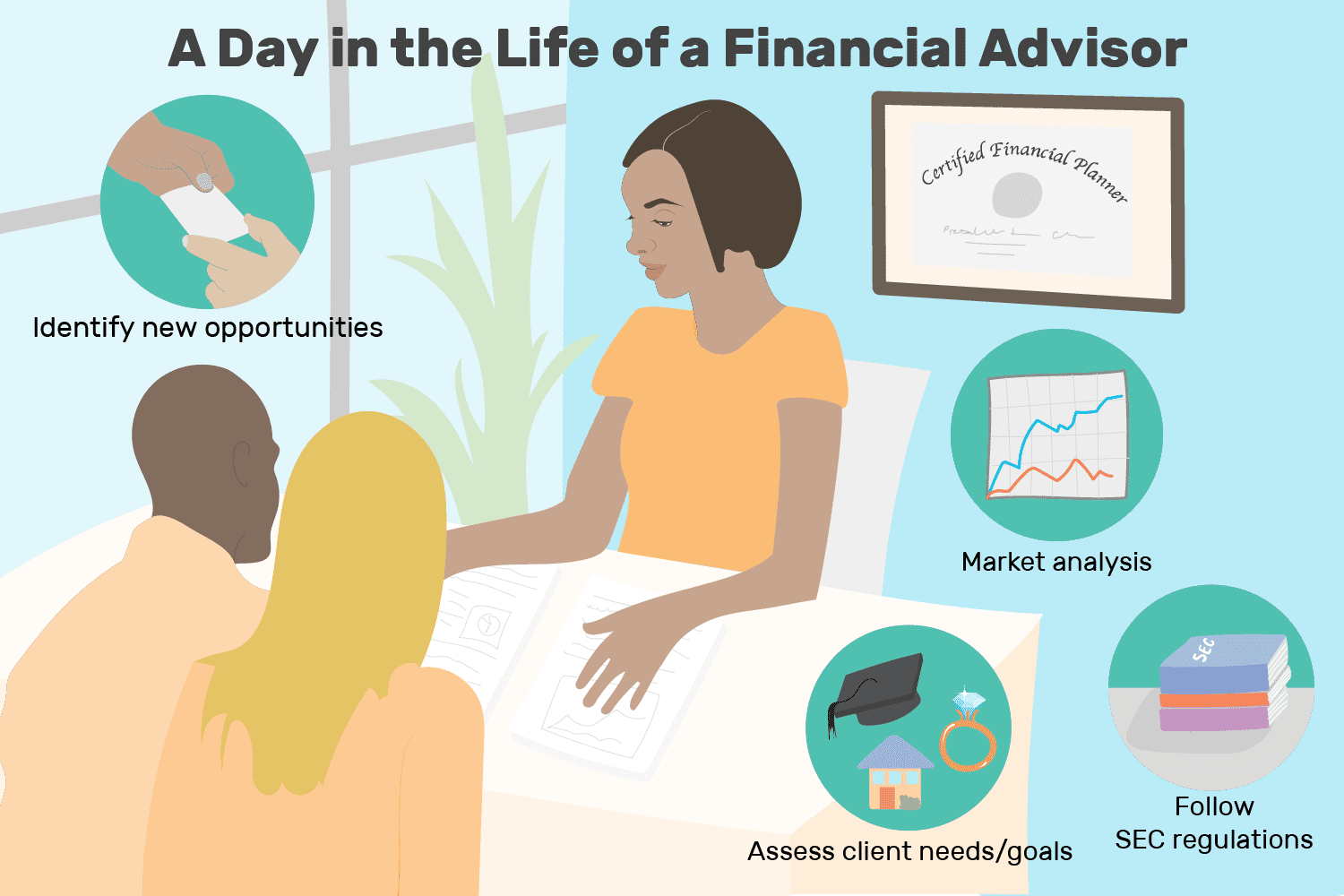

The Securities and Exchange Commission has increased regulatory requirements for financial advisors in the US, which affect sales incentives, fees, and securities recommendations. Many advisors consider regulators to be their enemies. In reality, however, the regulators are their partners and are working to make their jobs easier. These changes will impact financial advisors working in retirement and retail accounts. This will impact your firm's ability to offer retirement accounts and retail advice. Continue reading for more information.

Background checks

A background check can be done through any search engine. Simply enter the name of the financial advisor, along with its city and state, into a search engine. You will find a variety of information in the search results, including divorce records and legal judgments. Check for advisor-related articles. You should also be aware if there are any landmines prior to engaging an advisor.

Regulations changed since 2007-2008

The recent financial crises highlighted the failures worldwide of major regulatory systems. These allowed financial companies to abuse local housing markets and created a global financial disaster. A series of regulatory reforms may result in significant changes to the financial sector's functioning. But they should be designed to address the issues that led to the crisis. Here are three examples. It is important to address the root causes behind the crisis through regulatory reforms.

FAQ

What is retirement plan?

Financial planning does not include retirement planning. This helps you plan for the future and create a plan that will allow you to retire comfortably.

Retirement planning is about looking at the many options available to one, such as investing in stocks and bonds, life insurance and tax-avantaged accounts.

How can I get started in Wealth Management?

You must first decide what type of Wealth Management service is right for you. There are many Wealth Management service options available. However, most people fall into one or two of these categories.

-

Investment Advisory Services. These professionals will assist you in determining how much money you should invest and where. They provide advice on asset allocation, portfolio creation, and other investment strategies.

-

Financial Planning Services: This professional will work closely with you to develop a comprehensive financial plan. It will take into consideration your goals, objectives and personal circumstances. He or she may recommend certain investments based on their experience and expertise.

-

Estate Planning Services- An experienced lawyer will help you determine the best way for you and your loved to avoid potential problems after your death.

-

Ensure they are registered with FINRA (Financial Industry Regulatory Authority) before you hire a professional. You can find another person who is more comfortable working with them if they aren't.

What is Estate Planning?

Estate planning is the process of creating an estate plan that includes documents like wills, trusts and powers of attorney. These documents ensure that you will have control of your assets once you're gone.

How to manage your wealth.

First, you must take control over your money. It is important to know how much money you have, how it costs and where it goes.

Also, you need to assess how much money you have saved for retirement, paid off debts and built an emergency fund.

If you do not follow this advice, you might end up spending all your savings for unplanned expenses such unexpected medical bills and car repair costs.

Who should use a Wealth Manager

Anyone who wants to build their wealth needs to understand the risks involved.

New investors might not grasp the concept of risk. Bad investment decisions could lead to them losing money.

It's the same for those already wealthy. Some people may feel they have enough money for a long life. But they might not realize that this isn’t always true. They could lose everything if their actions aren’t taken seriously.

Every person must consider their personal circumstances before deciding whether or not to use a wealth manager.

Statistics

- As previously mentioned, according to a 2017 study, stocks were found to be a highly successful investment, with the rate of return averaging around seven percent. (fortunebuilders.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- As of 2020, it is estimated that the wealth management industry had an AUM of upwards of $112 trillion globally. (investopedia.com)

External Links

How To

How to Beat the Inflation by Investing

Inflation will have an impact on your financial security. It has been evident that inflation has been rising steadily in the past few years. Different countries have different rates of inflation. India, for example is seeing an inflation rate much higher than China. This means that even though you may have saved money, your future income might not be sufficient. You could lose out on income opportunities if you don’t invest regularly. How should you handle inflation?

One way to beat inflation is to invest in stocks. Stocks offer you a good return on investment (ROI). You can also use these funds to buy gold, silver, real estate, or any other asset that promises a better ROI. But there are some things that you must consider before investing in stocks.

First, decide which stock market you would like to be a part of. Do you prefer small-cap firms or large-cap corporations? Choose accordingly. Next, you need to understand the nature and purpose of the stock exchange that you are entering. Are you looking for growth stocks or values stocks? Next, decide which type of stock market you are interested in. Finally, be aware of the risks associated each type of stock exchange you choose. There are many stocks on the stock market today. Some are dangerous, others are safer. You should choose wisely.

If you are planning to invest in the stock market, make sure you take advice from experts. They can help you determine if you are making the right investment decision. Make sure to diversify your portfolio, especially if investing in the stock exchanges. Diversifying your portfolio increases your chances to make a decent profit. If you only invest in one company, then you run the risk of losing everything.

If you still need help, then you can always consult a financial advisor. These professionals will assist you in the stock investing process. They will ensure you make the right choice of stock to invest in. They can help you determine when it is time to exit stock markets, depending upon your goals and objectives.