Here's a guide to the average CFP salary for the U.S. We'll also talk about the educational requirements for becoming a CFP as well as income potential. We will be looking at Green River (Wyoming), which is the highest paying U.S. city and the reasons why it is so. Green River's average salary is 25.8% lower than that of the national average.

Average cfp salary U.S.

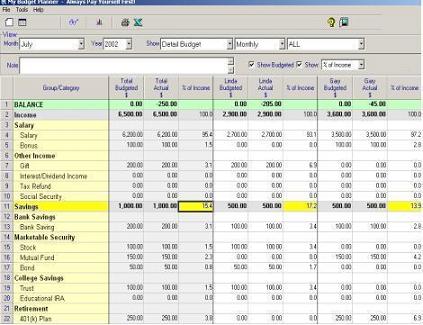

The average CFP salary varies by city, with Green River, WY paying 25.8% more than the national average. Located in the Western United States, CFP salaries in San Francisco and Santa Clara, CA are also high. Salary ranges can vary depending on where you live and how many years of experience you have. Below is a breakdown of the average CFP salary in U.S. cities.

The average certified financial advisor salary in the U.S.A is eighty-six million dollars. The average hourly wage is $40. Bonuses of approximately $3,663 per year are included in the salary. The Bureau of Labor Statistics predicts there will be twelve thousand additional jobs in this area over the next five year. CFPs are certified within two to three decades. Training is approximately 18-24 month long.

Requirements for a certificate of financial responsibility

There are several ways to fulfill the educational requirements required for a CFP. CFP Board Registered Education Programs will be the preferred route for most applicants. These programs vary in length and cost as well as their style. Some programs may be offered at major universities. Others are taught by smaller colleges and specialist schools. Online courses are also possible, as are blended learning programs that combine classroom with distance learning.

In order to qualify for CFP certification, candidates must have a bachelor's degree. This degree must be earned from an accredited college or university by the U.S. Department of Education. The degree may be in any subject, but it must have earned within five-years of the date the examination was taken. Tuition costs can range from $500 to $1,000, depending on the school.

Potential income potential with a cfp

The Income Potential for a CFP Salary is significantly higher than that of a typical financial advisor. Although a CFP certificant might not be able to serve more clients than non-certified ones, the income per client could increase by 14-33%. However, there are some caveats. First, a CFP does not necessarily engage clients holistically. They also generate income from a wider range of sources than non-certified advisors.

CFP salaries range from $48k to $60k for college graduates and up to $60k for experienced practitioners. CFP salaries can be affected by the high cost of living in particular areas. There are also other factors that can impact the cost of hiring such as competition between planning firms and other industries. Additionally, companies may consider hiring other professionals to ensure they get the best candidates.

FAQ

Who can I turn to for help in my retirement planning?

For many people, retirement planning is an enormous financial challenge. You don't just need to save for yourself; you also need enough money to provide for your family and yourself throughout your life.

When deciding how much you want to save, the most important thing to remember is that there are many ways to calculate this amount depending on your life stage.

If you're married, you should consider any savings that you have together, and make sure you also take care of your personal spending. Singles may find it helpful to consider how much money you would like to spend each month on yourself and then use that figure to determine how much to save.

If you're currently working and want to start saving now, you could do this by setting up a regular monthly contribution into a pension scheme. If you are looking for long-term growth, consider investing in shares or any other investments.

You can learn more about these options by contacting a financial advisor or a wealth manager.

What age should I begin wealth management?

Wealth Management can be best started when you're young enough not to feel overwhelmed by reality but still able to reap the benefits.

You will make more money if you start investing sooner than you think.

You may also want to consider starting early if you plan to have children.

You may end up living off your savings for the rest or your entire life if you wait too late.

What Is A Financial Planner, And How Do They Help With Wealth Management?

A financial planner will help you develop a financial plan. They can analyze your financial situation, find areas of weakness, then suggest ways to improve.

Financial planners are highly qualified professionals who can help create a sound plan for your finances. They can help you determine how much to save each month and which investments will yield the best returns.

Financial planners usually get paid based on how much advice they provide. Some planners provide free services for clients who meet certain criteria.

What Are Some Examples of Different Investment Types That Can be Used To Build Wealth

There are several different kinds of investments available to build wealth. These are just a few examples.

-

Stocks & Bonds

-

Mutual Funds

-

Real Estate

-

Gold

-

Other Assets

Each of these options has its strengths and weaknesses. For example, stocks and bonds are easy to understand and manage. However, stocks and bonds can fluctuate in value and require active management. Real estate on the other side tends to keep its value higher than other assets, such as gold and mutual fund.

Finding the right investment for you is key. It is important to determine your risk tolerance, your income requirements, as well as your investment objectives.

Once you have made your decision on the type of asset that you wish to invest in, it is time to talk to a wealth management professional or financial planner to help you choose the right one.

How can I get started with Wealth Management

It is important to choose the type of Wealth Management service that you desire before you can get started. There are many Wealth Management services, but most people fall within one of these three categories.

-

Investment Advisory Services – These experts will help you decide how much money to invest and where to put it. They offer advice on portfolio construction and asset allocation.

-

Financial Planning Services - A professional will work with your to create a complete financial plan that addresses your needs, goals, and objectives. He or she may recommend certain investments based on their experience and expertise.

-

Estate Planning Services: An experienced lawyer will advise you on the best way to protect your loved ones and yourself from any potential problems that may arise after you die.

-

If you hire a professional, ensure they are registered with FINRA (Financial Industry Regulatory Authority). You can find another person who is more comfortable working with them if they aren't.

What is risk management in investment administration?

Risk Management is the practice of managing risks by evaluating potential losses and taking appropriate actions to mitigate those losses. It involves monitoring and controlling risk.

Any investment strategy must incorporate risk management. The purpose of risk management, is to minimize loss and maximize return.

The key elements of risk management are;

-

Identifying sources of risk

-

Monitoring and measuring the risk

-

How to control the risk

-

Manage the risk

Is it worth employing a wealth management company?

A wealth management service should help you make better decisions on how to invest your money. It should also help you decide which investments are most suitable for your needs. This way, you'll have all the information you need to make an informed decision.

But there are many things you should consider before using a wealth manager. You should also consider whether or not you feel confident in the company offering the service. If things go wrong, will they be able and quick to correct them? Can they clearly explain what they do?

Statistics

- US resident who opens a new IBKR Pro individual or joint account receives a 0.25% rate reduction on margin loans. (nerdwallet.com)

- Newer, fully-automated Roboadvisor platforms intended as wealth management tools for ordinary individuals often charge far less than 1% per year of AUM and come with low minimum account balances to get started. (investopedia.com)

- According to Indeed, the average salary for a wealth manager in the United States in 2022 was $79,395.6 (investopedia.com)

- According to a 2017 study, the average rate of return for real estate over a roughly 150-year period was around eight percent. (fortunebuilders.com)

External Links

How To

How to invest once you're retired

After they retire, most people have enough money that they can live comfortably. But how do they invest it? The most common way is to put it into savings accounts, but there are many other options. You could also sell your house to make a profit and buy shares in companies you believe will grow in value. You could also take out life insurance to leave it to your grandchildren or children.

You should think about investing in property if your retirement plan is to last longer. You might see a return on your investment if you purchase a property now. Property prices tends to increase over time. You might also consider buying gold coins if you are concerned about inflation. They don't lose their value like other assets, so it's less likely that they will fall in value during economic uncertainty.